Mastering Real Estate Investing

Unlock Your Real Estate Potential with Our Comprehensive, Expert-Led Videos

Enroll in Course

You know that real estate has historically been the best way to build long-term wealth. But how and where do you get started?

Learn real estate investing through expert-led video training

Knowledge is your most valuable asset in the business of investing. And that's exactly what you've found here.

Since its original launch, this online course has evolved into an informative and engaging self-paced education that covers everything from the basics of real estate investing to advanced topics.

Real estate expert Frank Gallinelli — Ivy-League professor, best-selling author, and founder of RealData Software — teaches this in-depth video course, where you'll develop the skills and confidence to evaluate investment property opportunities for maximum profit.

Columbia University, Master of Science in Real Estate Development (MSRED) Program

What's New?

We frequently add new content to the course. In fact, the course now provides almost twice as many lessons as when we first released it! Whenever we add new material, it becomes available immediately to enrolled students at no additional cost. Some of our recent additions:

- Lease vs. Buy Analysis

- Can a Single-Family House or Condo (or a small multi-family) Work as a Rental Property Investment?

- Yield on Cost (a metric used often by developers and value-add investors)

- Phantom income

- Value-add investing

Master the techniques, metrics, terminology, and skills used by successful real estate investors

- Learn how to make smart, successful income-property investments, and how to distinguish potential winners from losers.

- Become fluent in the language of real estate investment and finance.

- See how experienced investors approach due diligence, valuation, financing, pro forma cash flow projections, resale, and more.

- Learn how to figure and interpret the metrics that are most important to income-property investors.

- Maximize your return and minimize your risks.

- See how different property types might present different opportunities and challenges.

The Only Course You’ll Need

Master these Key Concepts:

- The Four Basic Returns

- The Vocabulary of Real Estate Investing

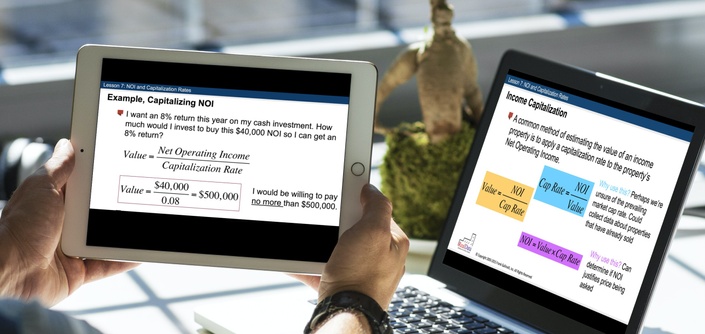

- The APOD and Income Capitalization

- Time Value of Money

- Real Estate Pro Formas

- Discounted Cash Flow Analysis

- Real Estate Investment Metrics

- Mortgage Financing and Underwriting

- Case Studies: Apartment, Mixed-Use, Triple-Net, Retail Strip Center

- Real Estate Partnerships

- Real Estate Development

- Value-Add Investments

- Lease vs. Buy

Become Skilled in Important Techniques:

- Estimate current market value

- Calculate and interpret key rate-of-return metrics

- Evaluate a property's long-term potential to meet your investment goals

- Understand what lenders look for and how much you can expect when you ask for financing

- Recognize the warning signs of a dicey investment

- Learn how to structure a partnership that profits everyone involved

- Plan out and evaluate a development or rehab project -- even fix and flip

- Explore the profit opportunities with value-add investments – and more

Invest in your future with our step-by-step approach — and pursue your investing goals with confidence.

- Each topic area features a series of short videos that focus on critical concepts. Move ahead at your own pace.

- Practice problems and simple spreadsheet tools will help you master essential calculations.

- Try your hand at property analyses with relevant case studies that feature a variety of property types and practical, real-life issues.

- Watch the video lessons on your smartphone or tablet as well as your computer.

- Earn an e-certificate that you can attach to your professional and social media profile.

When you complete this course, you'll know how to look at a potential real estate investment with a critical eye and how to "run the numbers" like a professional to decide at what price and on what terms a property makes good sense to you.

Enroll today and take the first step towards building wealth through real estate investing!

"The Real Data Intro to Real Estate Investment Analysis* is an outstanding course for all real estate professionals! The course is thorough, clear, concise, and professionally delivered. The content is very relevant to actual real life real estate investing. The case studies are particularly valuable as Frank Gallinelli walks you through the thought process of an investor when making high level decisions. I highly recommend this course to anyone working in fields related to real estate and especially for those looking to invest themselves."

Brad Trauth

Owner/Investor/Developer/REALTOR

Trauth Property Group

Who Should Take This Course?

- Real estate investing novices — Learn the techniques used by seasoned, successful investors so you can decide what to buy, how much to pay— and learn to avoid common, costly mistakes made by beginners

- Real estate professionals — Experienced investors and brokers recognize the benefit of updating, refreshing, and perhaps even enhancing their core skills. Never stop learning.

- Math-o-phobes — If you’ve avoided studying investment analysis because you’re afraid of the math, this is definitely the course for you. Clear and simple explanations, examples, and practice exercises will take you over that hurdle.

- Forward-thinkers — If you have an eye on your retirement, see how to leverage your portfolio and avoid costly pitfalls.

- Students — If you're carving out your path, we can start you off right to reach your potential. For more than a decade, Frank has taught material like this in his graduate school classes at Columbia University. You'll access quality education in this course.

Scroll below to the course curriculum to preview several of the lessons.

Your Instructor

Frank Gallinelli is the author of the best-selling book, What Every Real Estate Investor Needs to Know About Cash Flow... now in its third edition, as well as other books and numerous articles on real estate investing and finance. He is a graduate of Yale University with a degree in psychology, holds a Master's degree in education from Southern Connecticut State University, and served as Adjunct Assistant Professor in Columbia's Master of Science in Real Estate Development program for over a decade. Gallinelli has been involved in real estate for more than 40 years and is the founder and president of RealData, providing real estate software to equip and educate investors and developers for success. RealData's flagship product, Real Estate Investment Analysis (REIA), uncovers the value and potential returns of any income property, and the company's development applications guide you through multifamily, commercial, subdivision, and condo projects. With Gallinelli's video courses, you'll develop the confidence and skills to evaluate investment opportunities for maximum profit.

What are our students saying about this course?

Frank's course is a great resource, and provides a solid foundation for students to feel confident and prepared the day the program starts. I've even had graduate students decide to purchase it closer to the end of their studies, so they can use it as an occasional refresher, especially if they decide to go down a more entrepreneurial path. Frank is so organized and adept at explaining things, and the course is thoughtfully structured in many smaller manageable units, so you can click into it even when you have eight minutes between meetings.

Jessica Stockton King, Senior Associate Director, Academic Affairs

Columbia University, Master of Science in Real Estate Development (MSRED) Program

This course might have changed my life. Everything I ever wanted to know about real estate was addressed in great detail. Thank you immensely.

Your course has changed my mindset and the way that I view real estate. ...Thank you for giving me the knowledge, confidence and courage to start my real estate investing career - now it's time to put it into action. -- Troy Joseph

This is a great video series to learn how to calculate and evaluate income producing properties. The math is the same for all levels of investors. Frank makes sure that you don't just accept what is given to you but explains how to look beyond and see the big picture of the potential investment.

Frank does such an incredible job of breaking down what at first seem will be overwhelming complexity to digestible short videos that I can comprehend. It truly is like learning to eat an elephant one bite at a time.

...your wonderful ability to teach this material has made this a thoroughly rewarding and efficient education in Real Estate Deal Analysis. I am incredibly satisfied with the online course as well as the RealData Pro software… More personally, I really want to thank you for the confidence your education has given me… — I-Yeh

I just wanted to thank Frank and the team for offering such a great product. I've been looking for a stronger forward but sophisticated learning experience to fine tune my skills as I am leaning toward larger income properties. Thanks for sharing your time and knowledge. — Kevin Sweet

A helpful, insightful, and well-structured course that can take you from newbie to capable investor in relatively short order. Complex concepts are well explained and well illustrated with examples.

I felt this course was extremely useful for my start of multi-family apt investment. I had Frank's book, but this course was perfect for me. I have full confidence my ability to analyze different properties.

This is an AWESOME course. I only passed through once however, I will go through it again. I believe if I can master the thought process as well as the the tools and techniques. I will have a competitive edge in making, presenting and operating all property classes. Thank you for your time hard work and due diligence putting this course together. It is everything you're not told at the seminars.

I felt that this course has properly formed me to make informed, calculated and intelligent decisions in regards to my future real estate investment portfolio. You're the man Frank! I will highly recommend this course to anyone interested in the real estate investment world.

“Dear Mr. Gallinelli, thanks so much for explaining the hierarchy of a pro forma for an income producing property in a very simple way. Your skill to translate investment concepts in a clear fashion to real estate investors is outstanding” --Maibi Rojas

…thank you for your relentless passion to make sure your student succeeds. I am passionate about learning and I appreciate you so much for this.”-- Ola Ibiwoye

Thanks. These are the best courses ever! -- Ken Vance

Great course - especially for a beginner commercial investor like me.

The case studies were very very helpful to better understand the lesson in not only mathematically/numbers, but also conceptually and how a certain situation goes by in real life.

Your skill to translate investment concepts in a clear fashion to real estate investors is outstanding.

Course Curriculum

-

PreviewCourse Overview and Certificate Program (4:45)

-

PreviewAbout the Syllabus (8:49)

-

StartBONUS For students in my course: Save $100 on RealData's software for analyzing and evaluating real estate investment property

-

StartAbout the Captions and Subtitles

-

StartWhat is an Investment and Who is an Investor? (12:47)

-

StartWhat Do Income-Property Investors Really Buy? (12:00)

-

StartThe Four Basic Returns of the Income-Stream (10:46)

-

StartQuiz Lessons 1 to 3

-

StartProperty Analysis (11:50)

-

PreviewFinancial Terminology (9:58)

Frequently Asked Questions

We make no assumptions about your prior background or experience. The course will start with the basics, and from there it will move gradually into topics of greater depth.

Not at all. You'll find the math to be surprisingly simple, and I take special care to explain it clearly, with plenty of examples. Real estate investing is all about the numbers, and success comes to those who understand how the numbers work and what they mean.

The course includes more than sixty videos -- and growing. Don't worry about falling asleep, because each video is about 7 to 18 minutes long. You can watch each lesson as many times as you like to master its content. You will be able to access additional video lessons as they are added.

No. For lessons that focus on metrics or calculations, we provide a good number of practice problems and answers. We also include several spreadsheet templates that you can use to make many of the calculations and perform some of the analyses discussed in the course. We also provide quizzes so you can test your understanding of the material you've studied.

You don't need any outside software to take the course, although we do recommend you have Excel or a similar spreadsheet so that you can take advantage of the templates we provide. When you begin working on real deals of your own, we hope you'll take advantage of the powerful and sophisticated tools offered at realdata.com

"The course taught the most important concepts that I need to know in my early stage of learning real estate finance. The instructor has a keen talent for explaining the initially mind-boggling concepts in a painless way through easy-to-understand language and examples. I recommend this course to anyone who has any interest in the real estate field."

—Erica Lee

Professor Gallinelli has the magic to make complicated concepts easy to understand. ... I feel much more confident to analyze a property based on all the available information and to make informed decisions with limited information.

—Christina Chao

I found the course to be the perfect complement to your book. I appreciated the fact that each video is short which allows the user to digest the material in a simple fashion. I also like the fact that you incorporated a quiz to test my knowledge of each concept. All in all it was really what I was hoping for and I have way more confidence today when analyzing income properties than I did before the course.

—John Cameli